Why is investing more important than saving?

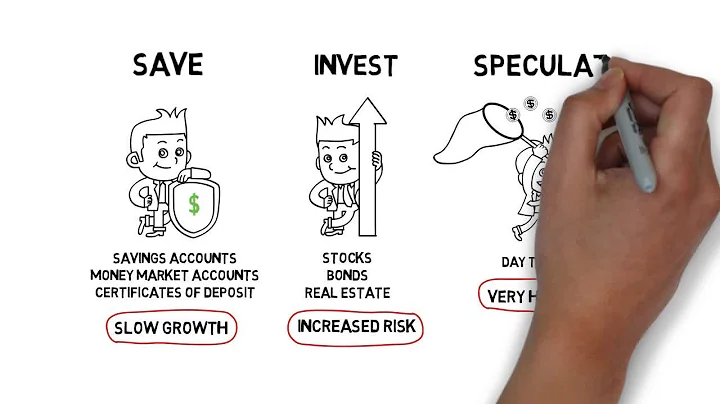

Saving and investing are both important components of a healthy financial plan. Saving provides a safety net and a way to achieve short-term goals, while investing has the potential for higher long-term returns and can help achieve long-term financial goals. However, investing also comes with the risk of losing money.

The biggest difference between saving and investing is the level of risk taken. Saving typically results in you earning a lower return but with virtually no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

As savings held in cash will tend to lose value because inflation reduces their buying power over time, investing can help to protect the value of your money as the cost of living rises. Over the long term, investing can smooth out the effects of weekly market ups and downs.

Usually money invested over the long-term can give higher returns than savings accounts, depending on interest rates and levels of risk. Consider investing if you: want the chance of getting a higher return than you'd get putting your money into a savings account. are willing to accept an element of risk to your money.

The correct answer is remain constant. National income is the final value of goods and services produced and expressed in terms of money at current prices. Savings are not part of GDP or Income. Hence, If saving exceeds investment, the National Income will remain constant.

Investing does not guarantee a return, and it is possible to lose some or all of the funds invested. Earnings potential. Investments typically have the potential for higher return than a savings account.

Cash equivalents are financial instruments that are almost as liquid as cash and are popular investments for millionaires. Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills.

- Grow your money when you start investing.

- Start investing to beat inflation.

- Achieve financial goals and spend on those you love.

- Achieve financial independence and retire comfortably.

- Investing is a necessary.

Even if you suffer losses in the short-term, you have more flexibility to recover and benefit from the positive effects of long-term investing. In other words, by investing early and regularly, you can take advantage of the power of compounding, which means your money can grow exponentially over time.

Aim for building the fund to three months of expenses, then splitting your savings between a savings account and investments until you have six to eight months' worth tucked away. After that, your savings should go into retirement and other goals—investing in something that earns more than a bank account.

What are the disadvantages of saving money?

- Interest rates are variable, not fixed.

- Inflation might erode the value of your savings.

- Some financial institutions require a minimum balance to earn the highest interest rate.

- Some accounts might charge fees.

But saving does not actually equal investment. Then what is saving? Saving includes income left from consumption and investment; value of part of consumption but not yet consumed in that period (waiting for the next period of consumption), and value of part of investment that is left for the next period of production.

Pros and cons of investing

Investing outshines saving in its return potential. Pro: Investing return potential is high. Over the long term, the average annual growth of the stock market is about 7% after inflation. At that growth rate, invested assets double in value about every 10.5 years.

When planned savings is less than the planned investment , then the planned inventory rises above the desired level which denotes that the consumption is the economy was less then the expected level which indicates at less aggregate demand in comparison to aggregate supply.

- You're building a strong emergency fund. Life throws curveballs. ...

- You end each month with extra money. Your emergency fund is looking good. ...

- You're ready to commit to some financial goals. ...

- You have access to a retirement plan. ...

- The signs say you're ready to start investing?

Savings accounts offer lower risk, while investing can potentially offer higher returns but with more risk. If you have a shorter timeline for purchasing a house (within the next few years), it may be better to save in a high-yield savings account or a CD to ensure the money is there when you need it.

A high-risk investment is therefore one where the chances of underperformance, or of some or all of the investment being lost, are higher than average. These investment opportunities often offer investors the potential for larger returns in exchange for accepting the associated level of risk.

While the product names and descriptions can often change, examples of high-risk investments include: Cryptoassets (also known as cryptos) Mini-bonds (sometimes called high interest return bonds) Land banking.

If 90% of millionaires come from real estate, then 100% of billionaires come from private equity. And every month I acquire several new companies. We've gotten into the game of mergers, acquisitions.

What makes up Musk's net worth. Musk lacks significant tranches of cash; his money is largely tied up in ownership stakes of his companies. To buy Twitter in 2022, he leveraged his large share in Tesla and solicited investors, rather than relying on liquid sums.

What are the 3 things millionaires do not do?

The 10 things that millionaires typically avoid spending their money on include credit card debt, lottery tickets, expensive cars, impulse purchases, late fees, designer clothes, groceries and household items, luxury housing, entertainment and leisure, and low-interest savings accounts.

High-risk investments include currency trading, REITs, and initial public offerings (IPOs). There are other forms of high-risk investments such as venture capital investments and investing in cryptocurrency market.

If the investment strategies do not perform as expected, if opportunities to implement those strategies do not arise, or if the team does not implement its investment strategies successfully, an investment portfolio may underperform or suffer significant losses.

- High-yield savings accounts.

- Certificates of deposit (CDs)

- Bonds.

- Money market funds.

- Mutual funds.

- Index Funds.

- Exchange-traded funds.

- Stocks.

The simple rule: If you need the money in the next three years, then save it ideally in a high-yield savings account or CD. If your goal is further out, or you don't have a specific need for the money, then start thinking about investing in something that will grow more, like stocks or bonds.

References

- https://www.nerdwallet.com/article/investing/the-best-investments-right-now

- https://finhabits.com/what-is-the-best-way-to-invest-to-save-for-a-house/

- https://www.bankrate.com/investing/saving-vs-investing/

- https://www.fca.org.uk/investsmart/understanding-high-risk-investments

- https://www.toppr.com/ask/question/when-planned-saving-is-less-than-planned-investment-it-indicates-a-situation-when/

- https://www.investopedia.com/articles/markets/121515/8-high-risk-investments-could-double-your-money.asp

- https://ethis.co/blog/reasons-why-you-should-start-investing/

- https://www.principal.com/individuals/build-your-knowledge/when-start-investing-4-signs-youre-ready

- https://www.tiktok.com/@kriskrohn/video/7249446262897085742

- https://www.washingtonpost.com/technology/2024/02/01/elon-musk-wealth-net-worth-companies/

- https://www.syndicateroom.com/alternative-investments/high-risk-investments

- https://www.fca.org.uk/investsmart/should-you-invest

- https://econwpa.ub.uni-muenchen.de/econ-wp/mac/papers/0510/0510014.doc

- https://www.lloydsbank.com/savings/help-and-guidance/save-or-invest.html

- https://smartasset.com/financial-advisor/where-do-millionaires-keep-their-money

- https://www.wsj.com/buyside/personal-finance/saving-vs-investing-01657732972

- https://www.usnews.com/banking/articles/what-is-a-savings-account

- https://www.debtfreedr.com/10-things-millionaires-do-not-spend-money-on/

- https://www.wellsfargo.com/goals-investing/saving-vs-investing/

- https://testbook.com/question-answer/if-saving-exceeds-investment-the-national-income--5c0a3eebe33ce40c9ea2b2bc

- https://www.fool.com/investing/how-to-invest/saving-vs-investing/

- https://www.investopedia.com/articles/investing/022516/saving-vs-investing-understanding-key-differences.asp

- https://www.wellington.com/en/legal/investment-risks

- https://www.investopedia.com/articles/personal-finance/040915/how-much-cash-should-i-keep-bank.asp